The Ultimate Guide To Spotminders

Table of ContentsGetting My Spotminders To WorkTop Guidelines Of SpotmindersSpotminders Fundamentals Explained9 Simple Techniques For SpotmindersHow Spotminders can Save You Time, Stress, and Money.The Greatest Guide To Spotminders

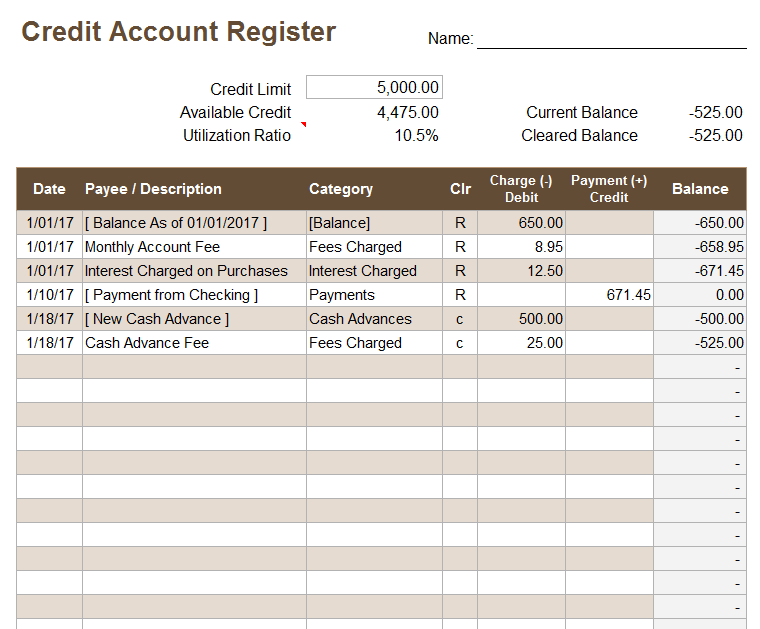

Date card was very first opened up Credit limitation you were accepted for. This aspects greatly right into Credit scores inquiries remain on your credit history record for two years. This impacts your credit report, and calling card are not consisted of For how long you have actually had the bank card for and elements into your credit history's estimation The yearly cost related to the charge card.

Do not hesitate to alter Utilizes solutions to computer system exactly how numerous days are left for you to strike your minimum spendUses the bonus offer and period columnsB When you obtained your perk. There is conditional formatting here that will certainly turn the cell green when you input a day. Whether the card fees costs when making international purchases.

All fields coincide as the ones in the main sheet. It is very important to track canceled cards. Not only will this be an excellent scale for my credit history, yet numerous credit report card perks reset after. That means, I will recognize when in the future, I can re-apply for the exact same card and obtain the bonus offer once again.

Spotminders - An Overview

Chase is without a doubt one of the most stringiest with their 5/24 rule but AMEX, Citi, Resources One, all have their own collection of rules also (tracking tag) (https://metaldevastationradio.com/sp8tmndrscrd). I have actually developed a box on the "Present Inventory" tab that tracks one of the most common and concrete guidelines when it comes to spinning. These are all made with solutions and conditional formatting

Are you tired of missing out on out on possible financial savings and charge card promotions? If so, this CardPointers review is for you. If you intend to, this app is a game-changer! Prior to I uncovered, I usually rushed to select the ideal bank card at checkout. Over the years as the number of cards in my purse grew, I battled with keeping an eye on all my deals.

Spotminders Fundamentals Explained

Ultimately, I wisened up and began writing which cards to make use of for everyday acquisitions like dining, this groceries, and paying details bills - https://www.quadcrazy.com/profile/41104-sp8tmndrscrd/?tab=field_core_pfield_1. My system had not been perfect, yet it was better than absolutely nothing. CardPointers came along and altered how I managed my credit scores cards on the go, giving a much-needed option to my problem.

Which card should I use for this acquisition? Am I losing out on unused perks or credits? Which credit scores card is in fact offering me the best return? This application responds to all of that in secs. This post has associate web links. I may obtain a tiny commission when you use my web link to buy.

It assists in selecting the appropriate credit scores card at checkout and tracks offers and rewards. wallet tracker. Lately featured as Apple's Application of the Day (May 2025), CardPointers aids me address the vital question: Readily available on Android and iphone (iPad and Apple Watch) gadgets, along with Chrome and Safari internet browser extensions, it can be accessed wherever you are

A Biased View of Spotminders

In the ever-changing globe of points and miles provides ended up being outdated swiftly. Not to mention, sourcing all of this information is taxing. CardPointers keeps us arranged with details concerning all our bank card and helps us promptly make a decision which cards to use for every purchase. Given that the app updates immediately we can confidently make one of the most informed decisions every time.

Just in instance you forgot card advantages, search for any kind of card information. CardPointers' user-friendly interface, along with faster ways, personalized views, and widgets, makes navigating the application simple.

Spotminders Things To Know Before You Get This

Failing to remember a card could be an evident blind place, so examine your in-app charge card portfolio twice a year and include your most recent cards as quickly as you've been authorized. This means, you're constantly up to day. CardPointers costs $50 a year (Regular: $72) or $168 for life time access (Regular: $240).

If you believe you'll enjoy this app, and conserve 30% off (tracking tag). CardPointers offers a totally free variation and a paid version called CardPointers+. What's the difference in between complimentary vs. paid? The complimentary rate includes standard functions, such as adding bank card (limited to among each kind), watching deals, and choosing the very best charge card based upon details purchases.

Spotminders - The Facts

Also this opt-out choice is not offered for consumers to quit bank card business and releasing banks from sharing this information with their monetary associates and economic "joint marketing professionals," a vaguely defined term that gives a giant loophole secretive defenses. Nor do consumers obtain the transparency they need to as to just how their information is being shared.

When the journalist Kashmir Hill looked for out what was being made with her Amazon/Chase credit score card data, both firms basically stonewalled her. The difficult variety of click-through contracts we're overloaded by online makes these notices simply part of a wave of fine print and even less significant. In 2002, residents in states around the country began to rebel against this policy by passing their very own, tougher "opt-in" monetary privacy rules calling for individuals's affirmative permission before their information might be shared.